Table of Contents

RDBX Stock

Did Redbox get excluded well, it is 2022 on Redbox is still around and seemingly still going on strong. Redbox (NASDAQ: RDBX) was founded in 2022 still operates around 40,000 rental kiosks around the country, while they are companies primarily dealt with blu Ray and DVD it movie rentals, it has briefly rented out of videos games asap well. And also, Redbox’s (NASDAQ: RDBX) stock is continuing to decline today after the company announced that has received extensive shareholders’ approval to merge with soul entertainment (NASDAQ: CSSE).

REDBOX first announced this is merger in May, valuing the company at the around $335, millions As a part of the agreement, RDBX stock they are own. At current prices, shareholders would receive partial CSSE shares worth of a little over $1 for each RDBX shares. Currently, RDBX stock trading in the latest data on July 15 Redbox carriers a short interest as well as a percentage of float of the 23.5%. In the other words, 2.25 millions shares are sold short , carriers a dollars volume of the $9.83. Millions. It has would only take 0.1 days to cover all that shares sold short. Further more. Shares sold short declined by 18.5%. From June

What happens to Redbox shares?

In May 2022, the two companies announced an agreement whereby Redbox shareholders will receive a fixed exchange ratio of 0.087 of a Class A common share of Chicken Soup for the Soul Entertainment per Redbox share. Chicken Soup for the Soul Entertainment announced Thursday that it has completed the acquisition of Redbox Entertainment in an all-stock transaction valued at approximately $370 million, after announcing the purchase agreement in May.

Did Redbox Get Delisted?

Well, it’s 2022 and Redbox is still here and still looking strong. Redbox (NASDAQ: RDBX) was founded in 2002 and still works approximately 40,000 rental kiosks across the country. While the company was primarily involved in renting Blu-ray and DVD movies, it also briefly rented video games.

Shares of Redbox (NASDAQ:RDBX) continued to fall today after the company announced it had received shareholder approval to merge with Chicken Soup for the Soul Entertainment (NASDAQ:CSSE). Redbox first announced the merger in May, valuing the company at around $335 million.

As part of the deal, investors in RDBX shares will receive 0.087 CSSE shares for each RDBX share they hold. At current prices, shareholders would receive just over $1 in CSSE shares for each share of RDBX. Currently, RDBX shares are trading in the $2 range.

According to the latest data as of July 15, Redbox has a short free float percentage of 23.5%. In other words, 2.25 million shares are retailed short, representing a trading volume of $9.83 million. It would only take 0.1 day to cover all shorted stocks. Additionally, stocks sold short were down 18.5% from June.

What Happens To My Shares If A Stock Is Delisted?

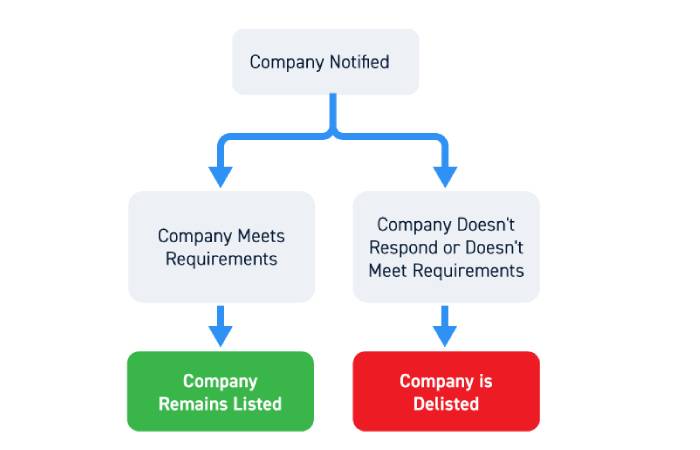

When a stock is removed from a stock exchange, it is considered delisted. This can be a voluntary action initiated by the company or an involuntarily action initiated by the exchange.

To be delisted means to be removed from an exchange, meaning the stock is no longer traded on that specific stock exchange. A company can elect to delist its stock, pursuing a strategic goal, but more commonly companies are forced off a stock exchange because the stock no longer satisfies certain minimum requirements. A stock dropping below $1 per share for an extended period of time can be one reason for delisting.

Rdbx Stock Delisted

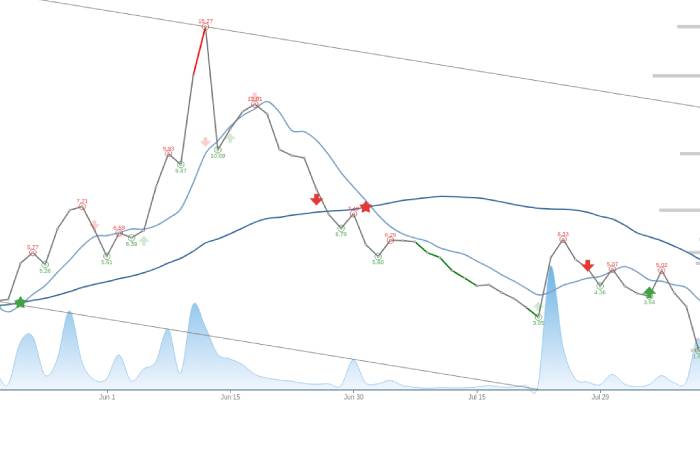

Redbox has performed so poorly as a public company that it has become a prime target for short sellers. Redbox has attracted huge short-term interest and, as of June 16, still held 125% of its free float in short positions. Sound familiar?

Between June 9 and June 10, RDBX jumped over 60% in two of the most bearish sessions of the year. This slowdown follows the release of May’s CPI report, which showed inflation at its highest level in 40 years. On June 13, the S&P 500 fell 3.88% and the NASDAQ 4.68%. Redbox shares rose 15.68% on a day when nearly all S&P 500 stocks were down significantly. On June 14, RDBX shares came full circle, falling 34%, wiping out most of their gains from the squeeze.

The brief interest in Redbox caught the attention of social media marketers as discussion about Redbox began to grow in mid-May. Sites like Chatterquant have been alerting their users to rising mentions of Redbox on social media since the stock bottomed around $2.00. Here’s an image of Redbox’s rise in popularity, which coincided with growing interest in the courts:

Rdbx Stock Chart

NAME

Redbox Entertainment Inc

IPO DATE

11/30/2020

WEBSITE

seaportglobal.com

EMPLOYEES

1,408

COUNTRY

United States

CURRENCY

USD

EXCHANGE

NASDAQ

TICKER SYMBOL

RDBX

SECTOR

Communication Services

INDUSTRY

Movies & Entertainment

PHONE

(630) 756-8000

ADDRESS

1 Tower Lane, Suite 800 Oakbrook Terrace, IL

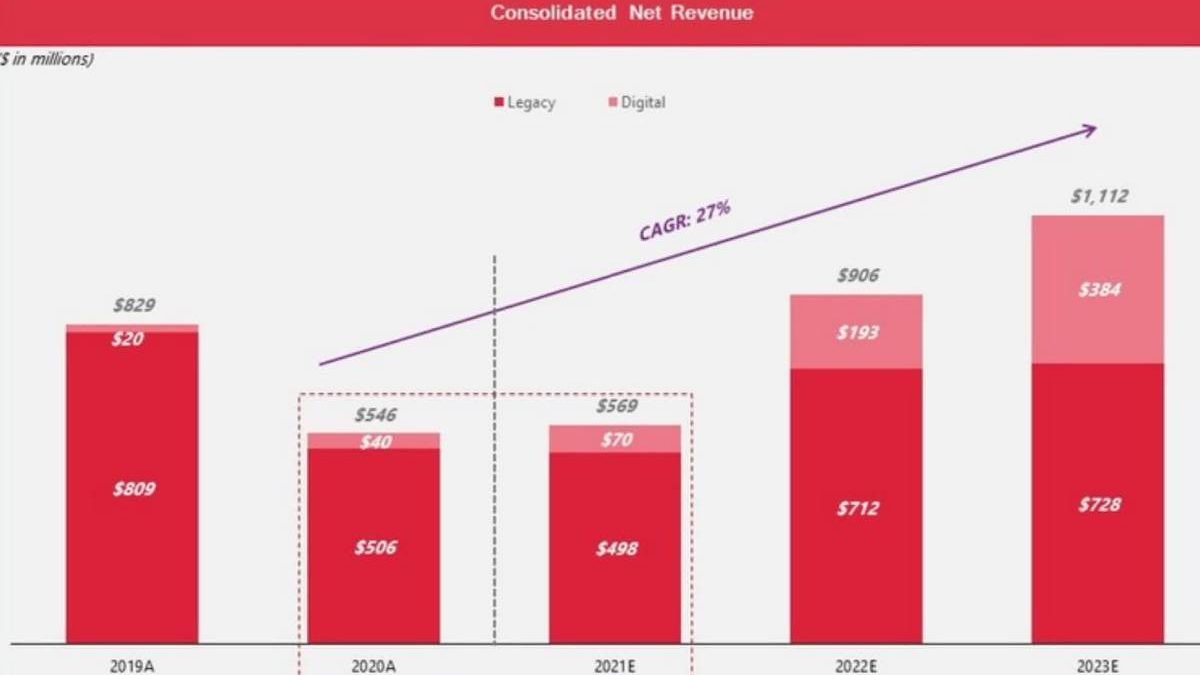

Redbox Entertainment, Inc. operates as an established brand and provider in the home video rental market in the United States. The company is headquartered in Oakbrook Terrace, Illinois and currently employs 1,408 full-time employees. The company went IPO on 2020-11-30. The firm is focused on providing its customers with entertainment, through physical media and/or digital services. The firm operates through two segments: Legacy Business and Digital Business.

The Company’s Legacy Business operates a network of approximately 38,000 self-service kiosks where consumers can rent or purchase new-release DVDs and Blu-ray Discs (movies). The Company’s Digital Business segment provides both transactional and advertising-supported digital streaming services, which include Redbox On Demand, a transactional service which provides digital rental or procurement of new release and catalog movies and television (TV) content; Redbox Free On Demand, an advertising -supported service providing free movies and TV shows on request, and Redbox Free Live TV, a free, advertising -supported television service giving access to over 130 linear channels.

What Happened To Rdbx Stock

So what exactly is 0.087 of a share of Chicken Soup for the Soul worth today? Around $0.55, given the stock’s roughly $6.40 share price. Redbox’s shares are trading at around $6.80 per share. Something here doesn’t add up, which likely tied back to investor sentiment. Indeed, it appears that Redbox has become a meme stock. Simply put, despite the highly likely outcome here, a small group of investors are gambling on a much more profitable result.

Now what

All but the most aggressive investors should avoid Redbox at this point. Perhaps the meme stock crowd knows something that everyone else doesn’t, but given the terms of the deal with Chicken Soup for the Soul, that seems highly unlikely. Today’s price move for Redbox doesn’t look rational and neither does its share price.

rdbx stock price history

Historical day-to-day price data is available for up to two years previous to today’s date.

For additional data, Bar chart Premier members can download additional historical data (since January 1, 1980) and download intraday, daily, weekly, monthly or quarterly data from the historical data download sheet. Extra underlying chart data and study values can be downloaded via the interactive charts.

Conclusion

Redbox Entertainment Inc (RDBX) stock is down -56.34% over the last 12 months and the average rating from Wall Street analysts is Buy. Investors Observer’s proprietary ranking system gives RDBX stock a score of 76 out of a possible 100. This rank is primarily influence by a fundamental score of 96. In addition to the average rating from Wall Street analysts, RDBX stock has a median target price of $8.66. That means analysts expect the stock to climb 99.59% over the next 12 months. RDBX’s rank also includes a long-term technical score of 79. The short-term technical score for RDBX is 52.