Table of Contents

Introduction:

Pancake Swap is a dispersed exchange platform developed on the Finance Smart Chain Network. What’s new about Pancake Swap is that it uses permission less liquidity pools that are only controlled by algorithms. These algorithms allow Pancake Swap to work fully automatically without depending on market makers because it has its automatic market makers.

The Pancake Swap logo addresses a hotcake, following the subject of the help. In this Pancake Swap survey and client guide, we’ll go over everything about Pancake Swap Cultivating, and that’s only the tip of the iceberg.

Hotcake crypto has been generally contrasted with Sushi Swap; notwithstanding, DEX is based on top of the Ethereum blockchain, which can be much more costly, while Pancake Swap is based on the Binance Savvy Chain. You could have likewise seen a ton of UniSwap, Pancake Swap, and SushiSwap correlations.

Pancake Swap has local area administration. It empowers clients to cultivate Liquidity, gives tokens, and integrates other explicit elements which make it stick out and allow you to acquire rewards.

The Pancake Swap cost additionally fluctuates in light of different elements. We should plunge and go over all that makes Pancake Swap so one of a kind.

What is Pancake Swap?

Pancake Swap is a decentralized trade based on the BNB Chain (beforehand BSC and Finance Chain) rather than Ethereum. It empowers its clients to trade BEP-20 standard tokens effectively.

The first thought of DeFi and DEX was to decentralize world funds. Crypto specialists envisioned a framework in which there would be no requirement for unified trade. Uniswap and SushiSwap arose as the market chiefs. However, there was a slanting pattern with the more significant part of the DApps being created on the Ethereum blockchain. This overdependence on the Ethereum network made difficulties, for example, slow exchange velocities and high gas charges.

Zeroing in vigorously on execution, Binance presented BSC in September 2020. PancakeSwap trailed behind and has turned into a competitor for the best position with its great highlights.

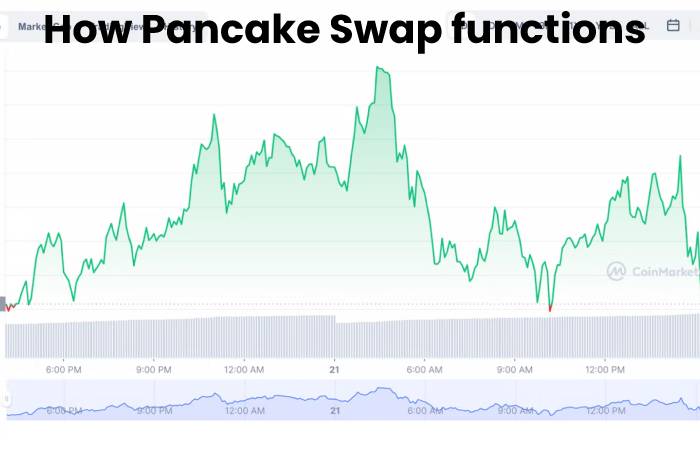

How Does Pancake Swap Function?

As referenced above, Pancake Swap is a decentralized trade that causes sudden spikes in demand for BNB Chain. It deals with the mechanized market creator (AMM) model rather than the customary market model, where there is a dealer and a purchaser. In the AMM model, dealers exchange advanced resources utilizing permission less liquidity pools.

Individuals store their assets in these liquidity pools. They get an LP (liquidity supplier) token consequently. They likewise get an expense for making their resources accessible for loaning. On the opposite side, individuals who need to utilize this liquidity pay a payment to the DeFi stage. This expense is subsequently disseminated among individuals who have added to the pool. Out of this pool, an apparent sum is kept in the Pancake Swap depository to keep up with the stage.

The AMM model allows you to procure by making liquidity for the pool. The more you contribute, the more you receive consequently. You can exchange LP tokens for benefits. Also, they can be cultivated in one more sort of liquidity pool to acquire Pancake Swap’s local BEP-20 tokens known as CAKE. That is not all: there’s one more sort of pool that is more remunerating than the others. These are called SYRUP pools. Individuals can stake their CAKE tokens to acquire significantly additional compensation from the SYRUP pools.

The Historical backdrop of Pancake Swap

Pancake Swap was sent off on September 20, 2020, days after the send-off of BSC. Pancake Swap is, at present, the third biggest AMM stage behind UniSwap and SushiSwap. Among the AMM arrangements created on BNB Chain, Pancake Swap remains at the highest point of the opposition. It has earned massive prominence inside a somewhat limited capacity to focus, in hypothesis, concerning the eventual fate of the DeFi market pioneers.

Its local token, CAKE, had a send-off cost of around $1.37 at its commencement, dropping to $0.25 shortly. From that point forward, CAKE revitalized to 20 bucks and saw its best grade coming to just shy of $44 on April 30, making it one of the most productive crypto speculations of 2021. From then forward, it has dropped because of different market drivers and is drifting from $4 to $6.

What Might You at any point Do on Pancake Swap?

The principal thing you want to do on the Pancake Swap stage is to add liquidity to the pool. In return, individuals put resources into the liquidity pools and gather a charge and CAKE (LP tokens). These are all BEP-20 standard tokens. Financial backers utilize these tokens in different ways to acquire benefits on the Pancake Swap.

Exchanging

Pancake Swap is a trade, although it is a decentralized one, and an essential capability it upholds is exchanging BEP-20 tokens. LP tokens will be given to liquidity suppliers that exchange for other BEP tokens. It is the same as a crypto exchange. Pancake Swap is worked for speed and security, assisting it with giving a smooth exchange experience.

Cultivating

The most beneficial method for acquiring on Pancake Swap is yield cultivating, which can give clients enormous returns. The LP token prizes procured beforehand can be developed in the Pancake Swap stage, which offers a method for gathering its administration token called CAKE. As this resembles a venture, you consequently end up securing your cash for remunerations. While effective financial planning and sitting tight for your CAKE rewards is called cultivating, receiving your benefits is known as collecting. Explore the Ranches tab on the sidebar to begin developing. The classification utilized here clearly looks like producing phrasing. The volume and season of the resource contributed are straightforwardly corresponding to the profits one gets.

Marking

Not every person exchanging digital currencies is a specialist who can exchange LP tokens and procure a benefit. With Pancake Swap, you can stake CAKE coins in the SYRUP pools to procure much more rewards. For the newbies in this field, marking is the ideal choice.

Best of all, these prizes are, at this point, not in that frame of mind of CAKE coins, as it were. Whenever you have marked your CAKE, you can unwind and procure an automated revenue. There are a couple other BEP token choices too. When you choose to trade out the prizes, you need to collect the harvest. Marking could sound like cultivating, yet you wind up securing your venture for a proper time frame in crypto marking.

NFTs

NFT represents Non-fungible tokens. Following its gamification approach, Pancake Swap makes it workable for clients to win unique NFTs, which can then be utilized for exchanging and marking. In any case, specific individuals like to gather these NFTs. Finance has fostered a particular convention that assists with producing NFTs more straightforwardly than previously.

Lottery

It is one more approach to bringing in cash on Pancake Swap. The stage runs four lotteries daily, with every lottery meeting running for six hours. You are expected to purchase a ticket with CAKE to participate in the lottery draw. On the off chance that you win, you might get an NFT as a prize.

Pancake Swap has another lottery pool called Ceramics, where you can store CAKE for a long time and have the potential for success to win from their award pot while procuring yield.

Beginning Homestead Contributions (IFOs)

To partake in beginning ranch contributions, you want to involve explicit tokens from PancakeSwap to get admittance to the recently sent-off tickets to offer. IFO is like ICOs and CEOs, which we will discuss further.

Which Is Better, Pancake Swap or Uniswap?

Both Pancake Swap and Uniswap are decentralized trades with unique elements that exist on various chains. It would be hard to analyze them as they serve multiple clients in their organizations.

Pancake Swap usually is the better decision for clients on the BNB Chain with BEP-20 tokens. At the same time, Uniswap is better for individuals who keep their exercises on the Ethereum blockchain or EVM viable chains.

Since Uniswap offers admittance to different EVM chains like Arbitrum, Celo, Hopefulness, Polygon, and Ethereum, it has figured out how to acquire two times the liquidity of Pancake Swap. Nonetheless, Pancake Swap gives more monetary items on its connection point than Uniswap, like an eternal trade, so this might draw in greater liquidity to the BNB Chain from now on.

The Advantages of Utilizing Pancake Swap

Pancake Swap entered the market to address the restrictions of Ethereum-based stages. With that in mind, Pancake Swap accompanies many underlying highlights that give it an edge over its opposition.

Following are a portion of the notable benefits of utilizing Pancake Swap.

- Interconnectivity: The [Pancake Swap] engineers realize that Ethereum overwhelms the DeFi space, and anybody involving [Pancake Swap] interestingly would see the value in some similarity between the two advances. Thus, [Pancake Swap] designers made it with an eye toward interconnectivity. Consequently, it upholds numerous well-known wallets, including Meta Mask, which stores and oversees BEP-20 and ERC-20 standard tokens. [Pancake Swap] has recorded multiple Ethereum-put-together coins concerning its trade also. It gives simple movement to individuals exchanging between the two blockchains.

- Usability: Pancake Swap’s UI has been intended to be spotless and straightforward. In any event, it is easy to explore and utilize for fledglings. Its immaculate exhibition gives a first-class exchanging experience. There will never be a lot for you to deal with, and you will not at any point be leaving since it got overpowering.

- Various Choices to Acquire: Pancake Swap’s clients can profit from different instruments and systems. You can cultivate, stake, or participate in NFTs and lotteries to procure a benefit. With countless such choices available to you, potential benefits are not far off.

- Quick: Pancake Swap accommodates speedier exchanges due to the organization’s complexity. Subsequently, brokers seldom miss out on exchanging an open door because of execution issues. They can be more proactive in answering any exchanging boosts and acquiring benefits by remaining on the ball.

- Modest Exchanges: With the congestion in the Ethereum organization, its exchange expense has gone as high as $20 per exchange now and again. Pancake Swap gives a lot less expensive exchange choice, with a typical payment of around $0.08. This cost differential has been one of the primary explanations behind its expanded prominence.

- Protection: You don’t have to give any administration-endorsed distinguishing pieces of proof to Pancake Swap regarding your security.

Pancake Swap News and Updates

- Pancake Swap reported a few changes following the Syrup pools rewards proposition on 9 August 2022. This proposition will diminish CAKE emanations from the Syrup pools.

- A 7,040,800 CAKE was signed from exchanging expenses, betting forecast, and lottery charges on 8 August 2022.

Getting everything rolling with Pancake Swap

The main thing you want to do before utilizing Pancake Swap is to make a wallet viable with BNB Chain.

A portion of the accessible choices are:

- Trust Wallet.

- BNB Chain Wallet.

- Coinbase Wallet.

You can likewise utilize Meta Mask, even though you might have to design your Meta Mask wallet so it can begin working with BNB Chain-based decentralized applications like Pancake Swap.

You can do this by getting to the Settings menu on Meta Mask. From here, find the Organizations choice and snap on Add Organization in the upper right corner of the page. Whenever you have done this, you will be explored to a page where you can fill in the accompanying boundaries:

Including liquidity Pancake Swap

After associating your wallet with BNB Chain, you can begin connecting with dapps like Pancake Swap and add Liquidity to one of the pools on the stage.

To do this, associate your wallet with Pancake Swap. You can do this by tapping on Associate Wallet at the upper right corner of Pancake Swap’s landing page.

When your wallet is associated, click on the Exchange menu and select Liquidity. Select Add Liquidity and pick the symbolic pair you wish to store on the Liquidity page. Note you should keep the two tokens in the pool at a foreordained proportion.

You will then, at that point, be expected to sign the exchange from your wallet (which is allowed to do).

From there on, you will get liquidity supplier (LP) tokens demonstrating your portion of the Liquidity kept in the picked pool.

Cultivating on [Pancake Swap]

Presently you have LP tokens, and you can exploit your holding by saving them in a “ranch” to procure CAKE tokens – the local digital currency of the [Pancake Swap] stage. Ranches are LP marking pools and permit you to acquire extra interest on your possessions.

Marking on Pancake Swap

It is feasible to intensify your income by marking your CAKE token on the stage’s Syrup pools. To do this, click on Pools on the Acquire drop-down menu. Here, you will find the collections accessible, the yearly rate yield (APY) of each and the aggregate sum marked.

First, you want to choose one of the pools. Then, you can actuate the CAKE marking on your wallet by tapping the Empower button. Then, enter how much CAKE you need to stake and snap Affirm. Contingent upon the pool you picked, your profit can consequently be gathered and marked in a similar collection.

NFTs on Pancake Swap

On Pancake Swap, there is additionally the chance to exchange BNB Chain-based non-fungible tokens (NFTs). To list your own NFTs on [Pancake Swap], you should apply by finishing up this structure.

About [Pancake Swap] (V2)

What Is [Pancake Swap] (V2)?

Pancake Swap (V2) is a well-known decentralized trade (DEX) permitting BEP-20 symbolic businesses on the BNB Chain. It is the most significant trade of the BNB Chain biological system and one of the top DEXs by a piece of the pie. The business utilizes a robotized market producer (AMM) model, permitting clients to exchange against a liquidity pool. You can turn into a liquidity supplier and get LP tokens, which qualify clients for a portion of the trade’s exchanging charges.

LP token holders can likewise participate in yield cultivating to acquire CAKE, the trade’s utility token. The token can be marked in alleged ‘Syrup Pools’ with adaptable or fixed-term marking. Adaptable marking permits clients to unstake whenever, while fixed-term marking augments yield and secures tokens for as long as 52 weeks.

Besides, Pancake Swap] (V2) offers a lottery where clients can win prizes in CAKE. On the NFT commercial centre, collectables can be exchanged, and with the NFT Profile Framework, clients can set up customized profiles. Clients can exchange renowned extended partners with influence to enter a more extraordinary situation than their record balance.

Who Are the Pancake Swap (V2) Originators?

The [Pancake Swap] (V2) pioneers are mysterious and head a two-dozen in number group of unknown “Cooks” working in the trade’s “Kitchen.” The exchange is open-source and evaluated by respectable security firms like Certik and Slowmist.

When Did [Pancake] Swap (V2) Send off?

[Pancake Swap] (V2) was sent off in September 2020.

Where Is [Pancake] Swap (V2) Found?

As it is a decentralized trade, the group works from a distance. In any case, as per Crunchbase, PancakeSwap has its base camp in Fukuoka, Japan.

[Pancake Swap] (V2) Confined Nations

There are no confined nations or districts since the trade is decentralized. Notwithstanding, the accompanying governments and communities are geoblocked: Cuba, Iran, Zimbabwe, Iraq, Crimea, Syria, Sudan, Belarus and the Popularity based Republic.